This is the 3rd post in the “Startup Pitching” series. In this post, we’ll go over advanced-level (301) techniques.

1. Timing is everything

Once you get good at using Dead Seagulls on your slides you want to take a page out of the comedian playbook… dramatic timing. If the image on a slide is particularly powerful, you don’t want to bring the slide up and then explain it. That will confuse the audience or rob you of the emotional punch you could have achieved. Instead, prepare the audience during the prior slide and then advance when the emotional timing is right.

2. Tell a story

At least a hundred thousand years before science and logic were developed we humans communicated via stories. Our brains are hard-wired to digest information packaged that way. Stories center on people, not bullet points. They have a protagonist and often an antagonist. So take your facts and craft a narrative around them.

You might start with a set of facts like this…

Our website allows customers to find and play games with friends, family, and strangers. Like a play-by-play on the radio, our game reads aloud all of the action and text chat.

And turn it into something more like…

Jane invites her grandson to join her in a game of cards on our site. Minutes later they, and several others, are playing and chatting. No one can tell who is blind and who is sighted… they only know who is winning – Jane!

And don’t just do it on one slide. Your protagonist should keep appearing in your story. Weave the narrative through as much of your presentation as possible. Here are some more advanced tips for adding narrative to your pitch.

3. Inoculate the audience

Most vaccines work by giving a person a weakened version of a virus/bacteria before they would normally encounter it. You can take the same concept and apply it to your pitch. If there is a certain kind of objection that comes up again and again during Q&A, that is a signal you need to address it right in your presentation.

For example, my first company made video games for the blind. It turns out that most investors thought that all blind people were also intellectually disabled. Once we realized this, we updated our pitch so that our narrative featured Jane (mentioned above) who clearly was not intellectually disabled. We made sure to introduce our blind teammate wrote code and skied.

4. Complexity kills

During a pitch, most investors look for reasons to say no. Idea too hard to follow? Decline. Financials too complex? Decline? We never got to my top question because we spent so much time on other questions? Decline!

Whenever possible, simplify. Does your product have 10 benefits? Only talk about the 2-3 most important ones in your pitch. Ditto if you have lots of customer segments, stakeholders, marketing channels, etc.

Sometimes a topic is complex and cannot be reduced. In this case avoid complex topics during a pitch and instead address them (and you absolutely must address them) during detailed due diligence meetings. Sometimes investors bring up complex topics during a Q&A. If that happens, you want to give a polite redirect. “Oh, I’d love to go into the details of our [product/financials/contracts/etc], but given the time constraints I know we can’t cover it fully. In our first due diligence meeting I’d be happy to focus on this and get you some materials to review ahead of time…”

5. Results not resumes

This is a specific application of the Show, don’t tell rule. The team section is one of the most important (arguable the most important) part of your presentation. Almost everyone does it the same way, by telling the audience about the resumes of their team members. This is dumping data on the audience and asking them to connect the dots. Also, resumes tend to emphasize the wrong facts.

As you want their funding/support, don’t make the audience work that hard! Spell out for people why your team is right for your venture.

In general, you should ditch the names, titles, degrees, and previous employer info. Instead, identify the 2-4 most critical skill sets a company like yours needs and then show examples of your team doing exactly those things… brilliantly.

The ideal team slide sounds something like this:

[for a company making artificial-intelligence software for hospitals]

From what I’ve told you so far, I bet you can see a few critical skill sets our team needs.

- The particular kind of artificial intelligence needed for this work is very rare. There are only about 1000 people in the world qualified to do it. We have five of them.

- Selling software to hospitals is notoriously difficult. Fortunately for us, previous to founding our company our CEO sold $100 million worth of software to hospitals.

The presenter narrowed it down to the 2 most important skill sets for a company like theirs and then showed how their team has a track record that should put funders’ minds at ease.

6. Risk reduction, not line items

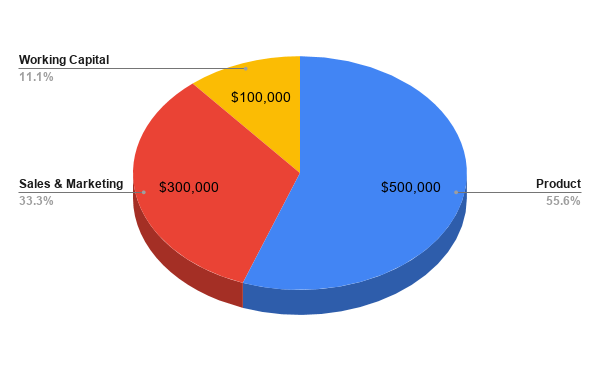

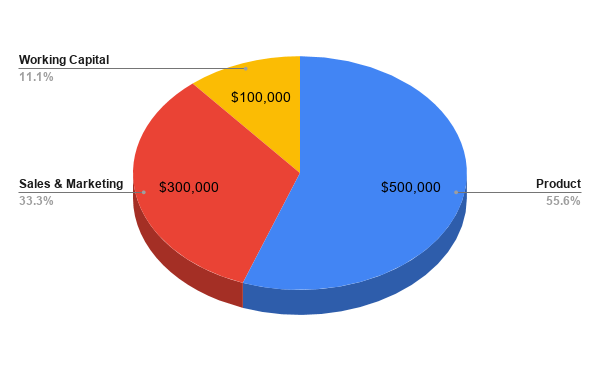

Entrepreneurs tend to explain to funders how they will spend money. Often in a graph that looks something like this…

This seems logical but it sends the wrong message. As a mentor once told me…

“Don’t tell me how much of my money you will burn. Tell me what amazing accomplishments my money will allow.”

A startup is a bundle of risks. Its valuation goes up as it mitigates those risks. So don’t tell us what things you are spending money on, tell us what risks you will mitigate.

Bad example: “This round of financing will be used primarily on working capital to keep us alive until we’re ready for the next stage.”

No one (except maybe your mother) cares about keeping your company alive :(.

Good example: “This round of financing allows us to get a commercial grade prototype into the hands of key influencers in our target market.”

This shows the funders that you A) know what your next major milestone is and B) this money will let you hit it. Staying alive to do so is understood :).

View the startup pitching checklist | View all posts in the “Startup Pitching” series